Iron Ore: How High For How Long?

Join us on 13th June as we discuss the latest development in the metals market, with particular focus on iron ore.

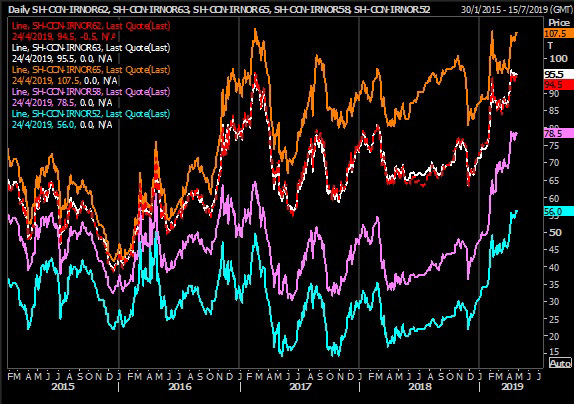

The deadly dam collapse in January at Vale’s mine in Brazil sent shockwaves far beyond the devastated community of Brumadinho, propelling global iron ore prices up by over 25 percent as traders and steel mills grappled with potential supply disruptions of the critical steel-making ingredient. This session will explore where the market will be able to source alternative ore supplies, and address whether China’s sputtering economy can fuel sustained demand for iron ore as the $100 price tag comes into view.

Iron ore prices / Source: Refinitiv

Agenda

| 14:30 | Registration & Networking |

|---|---|

| 15:00 | Welcome & Introduction |

| Byron Larkins, Head of Corporates and Commodities Market Development, ASEAN, Refinitiv | |

| 15:05 | The return of $100 iron ore, how long will it last? |

|

|

| 15:35 | Macro outlook for metals |

|

|

| 16:00 | China's iron ore market |

|

|

| 16:25 | Panel Discussion |

| Moderator: Gavin Maguire, Editor in Charge - Commodities Asia, Reuters Josh Qiao, Senior Manager, Dalian Commodity Exchange DCE) Bernd Sischka, Global Head of Metals (Base, Precious, Iron Ore), Refinitiv Ian Roper, General Manager, Shanghai Metals Market (SMM) Mai Nguyen, Asia Metals Correspondent, Reuters |

|

| 17:00 | Networking reception |

Event info

-

Date

13 June 2019, Thursday -

Time

2:30pm - 5:00pm -

Location

One Raffles Quay, North Tower, Level 28, Singapore 048583 -

Topic

Iron Ore: How High For How Long? -

Speakers

Ian Roper General Manager, Shanghai Metals Market

Ian Roper joined SMM (www.metal.com) in late 2017 to drive their international expansion and help bring their deep understanding of Chinese metals markets to a wider audience. Ian is a highly regarded industry analyst, with over 17 years’ experience in metals, starting at CRU in London. Since 2003 Ian was based in Shanghai, China initially with Steel Business Briefing and then Macquarie, before a five year stint at Rio Tinto running their iron ore analysis. Over 2010-2017 Ian worked as a sell-side analyst with CLSA and Macquarie based in Shanghai and Singapore

Bernd Sischka Global Head of Metals (Base, Precious, Iron Ore), Refinitiv

Bernd joined Refinitiv in 2014 as Global Head of Metals and Iron Ore in London to drive the growth of their global metals business for desktop products (Eikon) and data-feeds as well as transitioning a 15 head research team to provide frequent and insightful precious and base metal analysis to global clients. After 7 years in investment banking covering fixed income at Lehman Brothers and commodities trading at Credit Suisse, he ran the metal trading desk at Alaska Metals

Josh Qiao Senior Manager, Dalian Commodity Exchange (DCE)

Josh Qiao joined Dalian Commodity Exchange (DCE) in 2015; he is currently senior manager of Singapore Representative Office, working closely with industry leading organizations who are commodity merchants, miners, investment banks and brokers. Prior to relocating to Singapore in 2018, Josh worked in Agriculture Products Department, where he played important roles in futures contract amendment and product development. Josh accumulated rich experience in derivative market operation and regulation. He also has comprehensive insights into agriculture and iron ore industry.

Josh studied Economics at University of Wisconsin – Madison. He received his master’s degree in Actuarial Science from Columbia University. He is an Associate of Society of Actuaries (ASA).