INDONESIA FX MATCHING LAUNCH

Welcoming Indonesia to the world's biggest primary market for FX

Exclusively for Banks in Indonesia:

Launch of electronic interbank USD/IDR spot trading

Refinitiv is delighted to announce the launch of an electronic marketplace for onshore USD/IDR spot foreign exchange trading on 30 June 2021, following many discussions with Bank Indonesia and market participants over the last few years.

We are honored to be a long-term partner of the Indonesian financial industry and look forward to working with you on this exciting development for the IDR market.

Our team have already reached out to banks in Indonesia to explain the details of the market-wide launch at the end of the month. However if you have not heard from us, please do not hesitate to get in touch immediately.

Arm yourself with the available resources to prepare for your first trade, join our complimentary training sessions to find out how to accelerate your business with Matching.

What is FX Matching?

Matching is an Anonymous Central Limit Order Book for FX

Matching is a regulated, electronic, central-limit order book trading venue for interbank FX and will offer USD/IDR for onshore banks. Existing users of Refinitiv FX Trading terminals will be able to easily onboard the service which requires banks to assign credit limits to their counterparties. Pre-trade prices are all anonymous and real-time credit screening allows for fast and assured execution.

How does Matching work?

- Only licensed banks in Indonesia will be enabled to trade USD/IDR on Matching

- Each bank assigns a daily credit limit for their counterparties, set up in the Matching Credit Admin GUI

- Traders enter buy / sell orders on their screen in lots of USD 1 million

- Orders are screened in real time for bilateral credit

- Traders view market best price / quantity and executable best price / quantity, up to 5 levels of market depth

- Traders trade by hitting executable prices (partial fills or multiple counterparties are possible)

- Credit limits are reduced by the traded amount in real time

- Matching trades will be automatically reported to Bank Indonesia

- Trade data can also captured via TOF/XML/FIX for internal STP using existing infrastructure

- Credit limits are automatically reset overnight to the original settings

What does it mean for banks in Indonesia?

- Deep liquidity

- Efficient FX trading

- Effective price-making

- Anonymous trading

- Assurance

- Trust

Matching as a primary market for FX

Benefits for spot traders

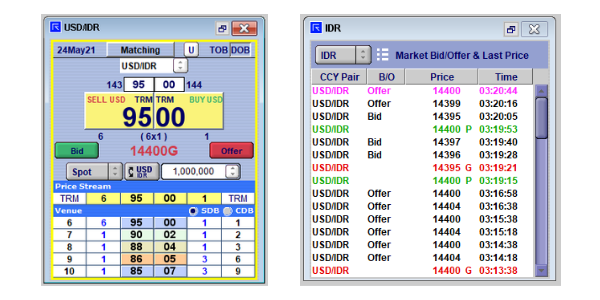

How does it look like?

Pricing Montage & Active Markets

TRAINING SESSIONS

REQUEST FOR MORE DETAILS

By submitting your details, you are agreeing to receive occasional communications about Refinitiv resources, events, products, or services. You also acknowledge that you have read and understood our Privacy Statement.By submitting your details, you are acknowledging that you have read and understood our Privacy Statement.

Refinitiv Indonesia FX Awards 2021

Top participating banks will be presented with awards including the "FX Trader of the Year" and "FX Bank of the Year". We look forward to seeing you in the winner's circle.

Tips and Tricks in Using FX Matching for FX Traders Indonesia market

10 August, 11:30AM WIB (45 mins)

Discover MCA and FX Matching for Indonesia market

19 August, 11:30AM WIB (45 mins)