Risk Free Rates (RFR)

and Valuation platform

A comprehensive tool for Compounding calculations and Valuations

Refinitiv launches Risk Free Rates (RFR) and Valuation platform

As IBORs are being replaced by RFRs, there’s an immediate necessity for market participants to understand the impact on loans payments and receivables; implement derivatives valuations, and perform derivatives valuations quoting legacy IBOR’s against the new benchmarks. It isn't a simple task, and banks are looking for a cost-effective solution that will help them navigate the complex transition from IBOR to RFR.

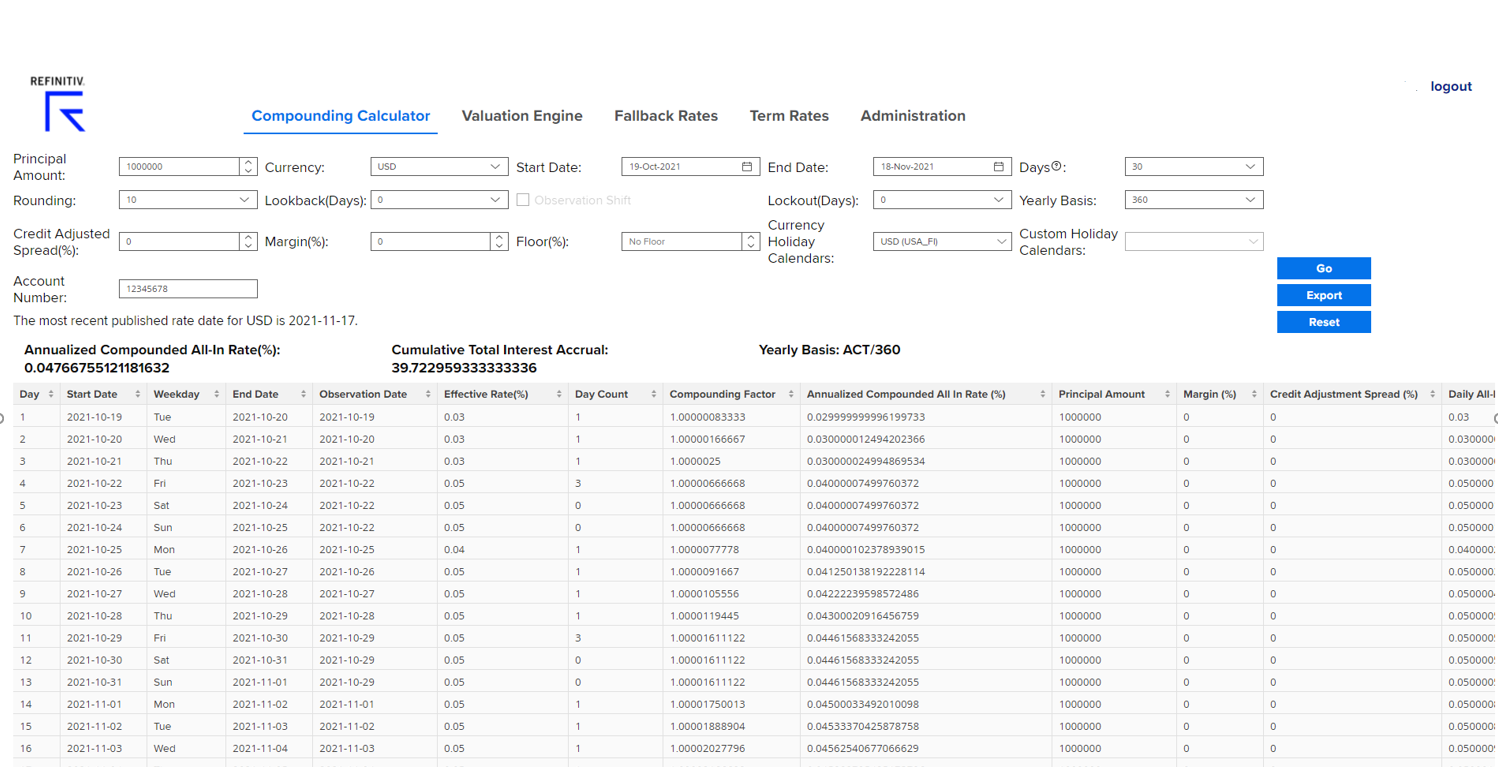

Refinitiv has built a Compounding Calculator that helps banks in computing backward-looking RFRs and projects them to forward-looking interest rates. With this they also get a Valuation tool that converts interest rate and cross currency swaps to RFR exposures from IBOR exposures, considering ISDA fall back rates.

Why choose the RFR and Valuation Platform?

- Customized calculations

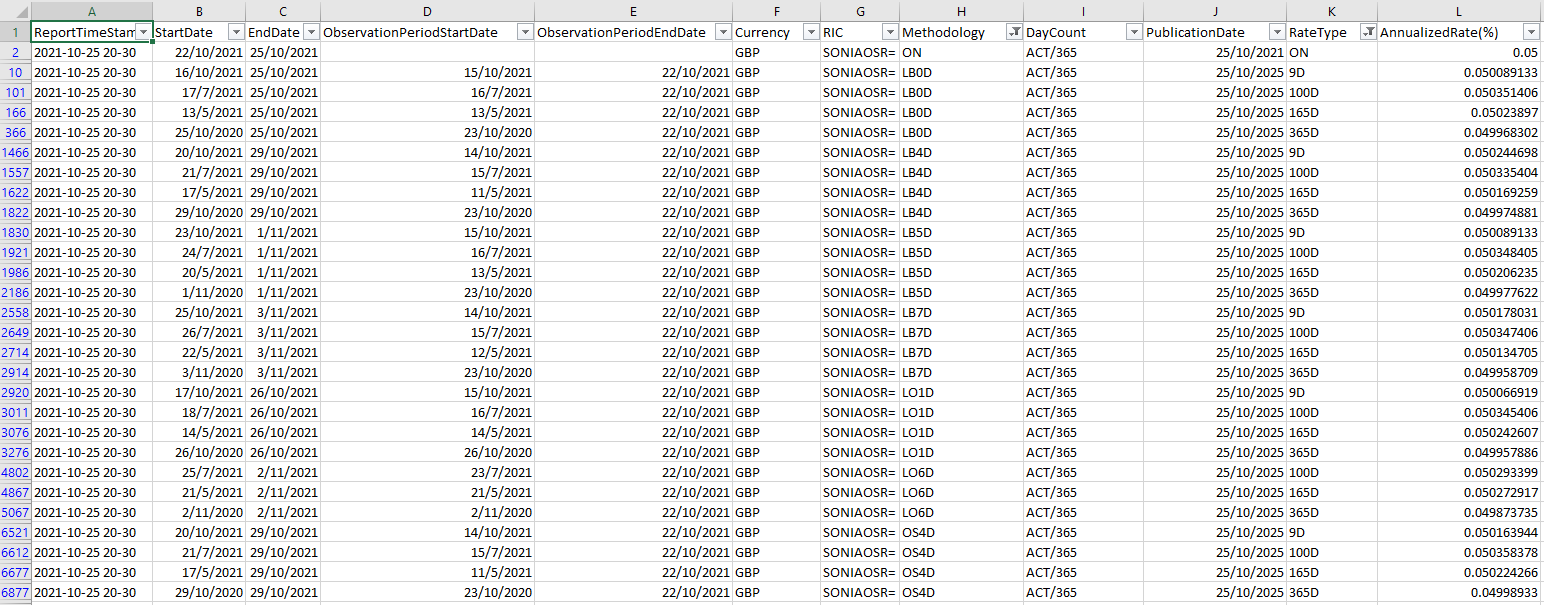

- Clients can integrate daily rates into their core banking system.

- Automated and secured delivery of calculations

- The underlying currency swap prices are derived from the market-leading execution venue for EUR, USD, and GBP interest rate derivatives.

- Currency exchange pricing underpins SOFR data sets, contributing to approx. 70% of the ICE Swap Rate benchmark (formerly ISDAFIX).

Snapshot of the dashboard

Example of an output to be loaded into core banking system

Who can benefit from it?

Market Risk, Treasury, Financial Accounting and Credit Risk management teams in Banks and financial institutions.

How does it help clients?

- Discover ISDA Fallback supplement and protocol

- Understand calculations and how they will impact people's decisions.

- Review or reconstruct interest rate curve environment for every financial institution for the valuation of products.

- Recreate interest rate multi-curve environments and address several cross-dependencies during LIBOR transition.

- Classify the valuation portfolio by exposures and instrument types and set up new benchmark rate curves for all impacted products.

- Identify liquidity risks associated with IBOR.

What you get with our solution?

- 10 Risk Free Rates that this product currently supports SOFR, CORRA, SONIA, ESTR, SARON, THOR, SORA, HONIA, TONAR, and AONIA.

- Easy onboarding of more Risk Free Rates.

- Integrate daily compounded rates into the core banking system through:

- Bulk file delivery of new RFRs each day.

- Generating customized output files on SFTP with tenors from 1-365 days and applying base case (no shift), Lockout, Lookback, and Observation Shift scenarios up to 10 business days

- One comprehensive dashboard to manage.

- API access: all backend components can also be access through REST API calls. A Postman collection can be made available to clients to develop their own non-GUI client application which allows to create an automated end-to-end workflow.

In our latest blog, we take an in-depth look at the remaining challenges that surround the imminent transition, as well as the potential of data-driven solutions to enable a smooth changeover. Read blog >

Discover how the combination of Yield Book's analytical expertise and Refinitiv's established terms and conditions, pricing and other key data sets delivers a seamless LIBOR transition. Learn more >

In this episode of our deep-dive interview series, we take a look at the LIBOR transition. What’s happening? Why is it happening? And what do customers need to do, in order to be ready for this transition?

Get in touch now to know more about how Risk Free Rates and Valuation Platform can support your workflow.

Refinitiv, is one of the world’s largest providers of financial markets data and infrastructure. Serving more than 40,000 institutions in approximately 190 countries, we provide information, insights, and technology that drive innovation and performance in global markets. Our 160-year Reuters heritage of integrity enables customers to make critical decisions with confidence, while our unique open platform, best-in-class data, and cutting-edge technology bring greater opportunity to our customers. By advancing our customers, we drive progress for the entire financial community.