Build sustainability into your investment strategy with our environmental, social, and governance (ESG) data and services, covering thousands of companies.

Putting ESG thinking at the heart of your investment process

Designed to help you make sound, sustainable investment decisions, our ESG investing information covers 80% of global market cap and 76 countries over 630 metrics.

It helps you assess the risks – and opportunities – posed by companies’ performance in critical areas such as climate change, executive remuneration, and diversity and inclusion.

You can carry out your ESG research with complete confidence because every data point is rigorously quality controlled and verified to ensure that it is standardized, comparable and reliable.

Our Fund ESG Scores provide you with independent fund level scores highlighting the sustainability of particular investment funds.

As well as ESG data and scores, we offer sustainable bond information to help assess sustainable Fixed Income strategies and investments.

Firms can use our ESG Contributor Tool to upload ESG data to the Refinitiv ESG database to ensure thousands of investors are able to retrieve the full view of a company. Refinitiv’s ESG data is available in Eikon, Excel Add-ins and Datastream; feed solutions via DDL, RDP Cloud API.

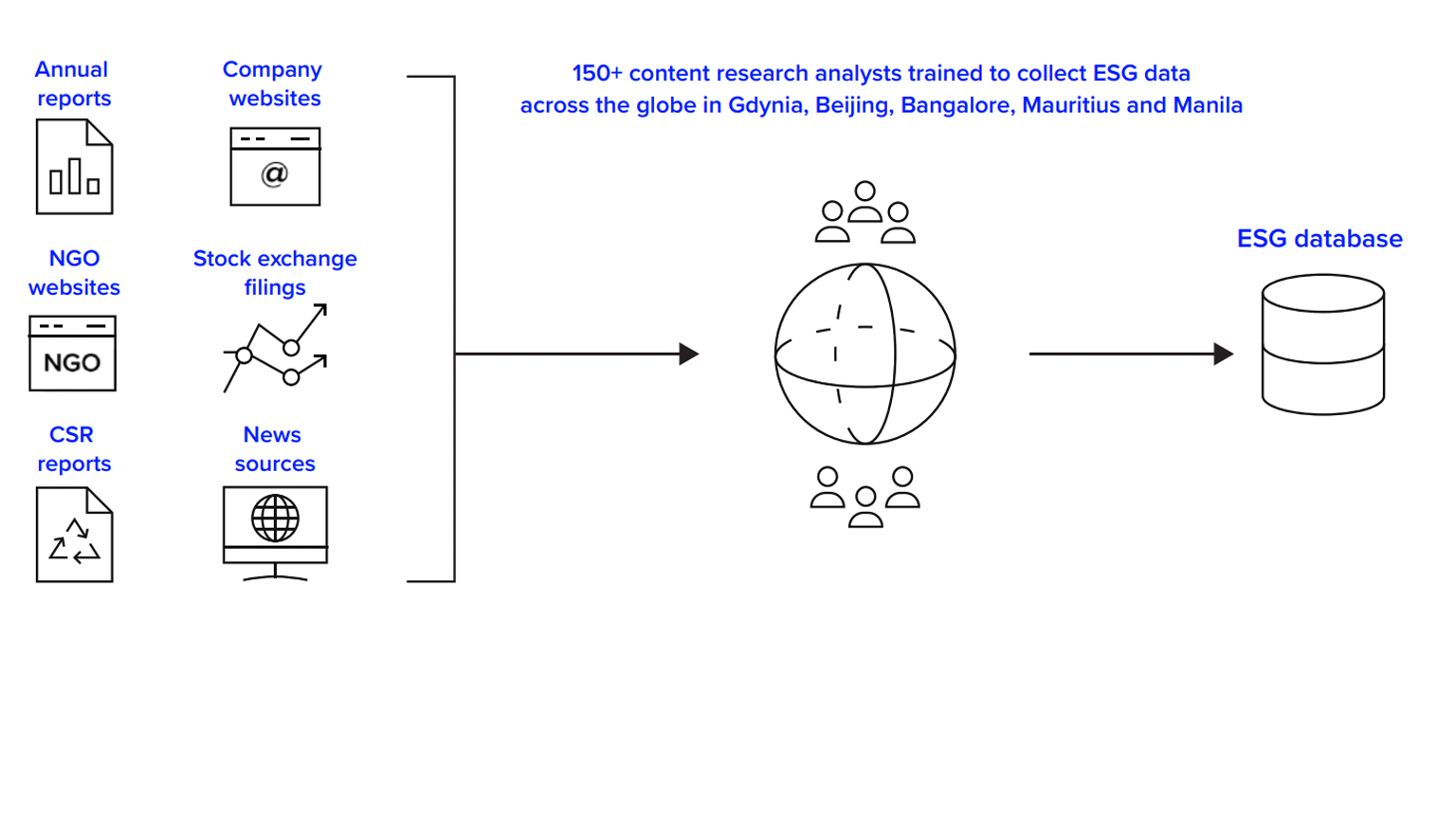

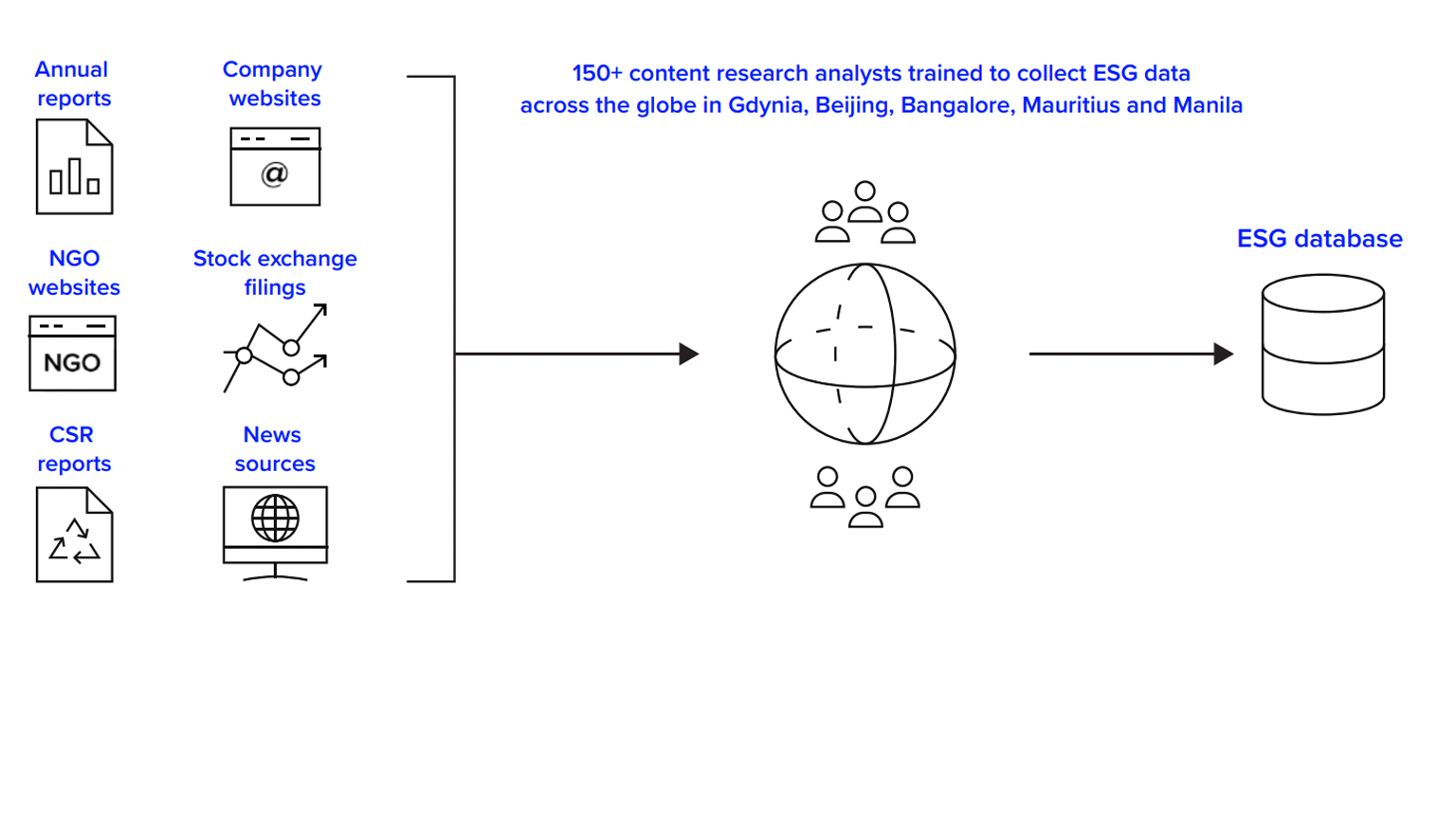

With our standardized ESG data points (630+) and analytics (70+) – for nearly 80% of global market cap based on publicly reported company data and 210 countries – we strive to be the industry standard database that reflects official company disclosure on environmental, social, and governance (ESG) metrics.

We believe that company disclosure and standards of reporting on these issues is critical for driving accurate investor information, public discourse, regulatory guidance.

We also believe that transparency is critical to driving positive outcomes at both a financial and social level.

To this end – for the purposes of company scoring – we do not use, create, or collect data that is not disclosed or publicly available.

As such, we can create a complete line of auditability all the way from documents (such as annual reports), to the company data points in our database, to company scores, to fund ratings which are based on robust fund holdings data.

Access quality environmental, social, and governance data on thousands of companies worldwide for scoring and ranking.

Compare and benchmark companies with transparent, standardized ESG data points and standardized ESG analytics.

Rapidly measure sustainable investment decisions and support ESG investment applications with our comprehensive ESG indices.

As transparency becomes increasingly important, our ESG investing information is an invaluable reference tool for research analysts.

Import raw data straight into Excel effortlessly, and use ready-made templates.

Perform positive and negative screening on criteria such as alcohol, armaments, carbon, and controversies in the media.