Drive sustainable and socially responsible investing

“Sustainability must become the new norm – and be at the heart of everyday decisions that we make as citizens, as consumers and as investors."

Elena Philipova, Global Head of ESG Proposition at Refinitiv

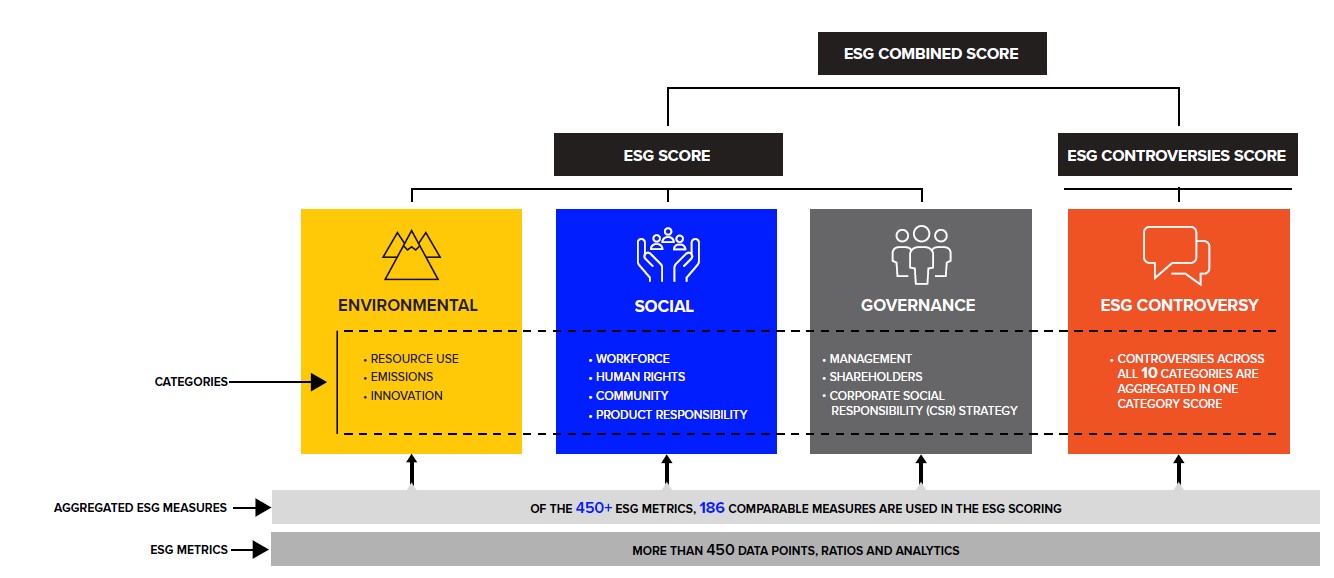

Driving sustainable and socially responsible investing business, ethics and corporate governance are now moving to the forefront as metrics to identify how well a company is performing. Investors are increasingly demanding that environmental issues be factored into their portfolios and financial professionals in response, are differentiating their services using environmental, social and governance (ESG) criteria into the screening workflow.

Our approach to ESG:

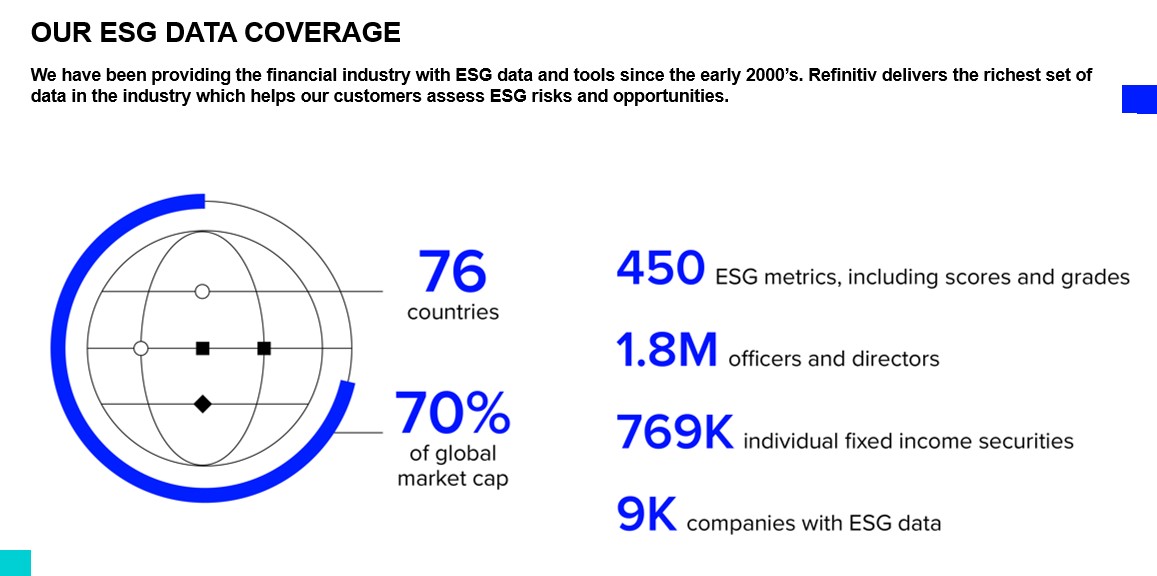

Refinitiv provides Environmental, Social and Governance data to help Wealth Advisors integrate ESG factors into the investment workflow, including portfolio analysis, equity research, screening or quantitative analysis. Our ESG data enables Wealth Advisors to screen over 70% of global market cap across 100s of granular and reliable ESG metrics so they can efficiently meet investment mandates and provide insight into sustainable investments to customers.

We help market participants easily assess the ESG risks and opportunities in portfolios, benchmark against peer companies and make more informed investment decisions with a socially responsible investment mandate or interest.