HEDGE FUND SOLUTIONS: GLOBAL MACRO

JUMP TO:

Build a robust picture of virtually any macro environment.

The foundations for building your macroeconomic analysis and testing your strategies should be deep and rock-solid.

Refinitiv is the leading provider of global macro content with Refinitiv Datastream, the world's most comprehensive financial time series database. Loaded with 70 years of information across a mix of key asset classes.

Connect with our hedge fund solutions team

Refinitiv Datastream is the world's largest cross-asset database with 8.5 million active economic indicators.

Datastream has origins going back to the 1950s and covers 175 countries, with new coverage announced frequently. Content can accessed via our desktop platform, Refinitiv Workspace, or through a variety of APIs or database solutions.

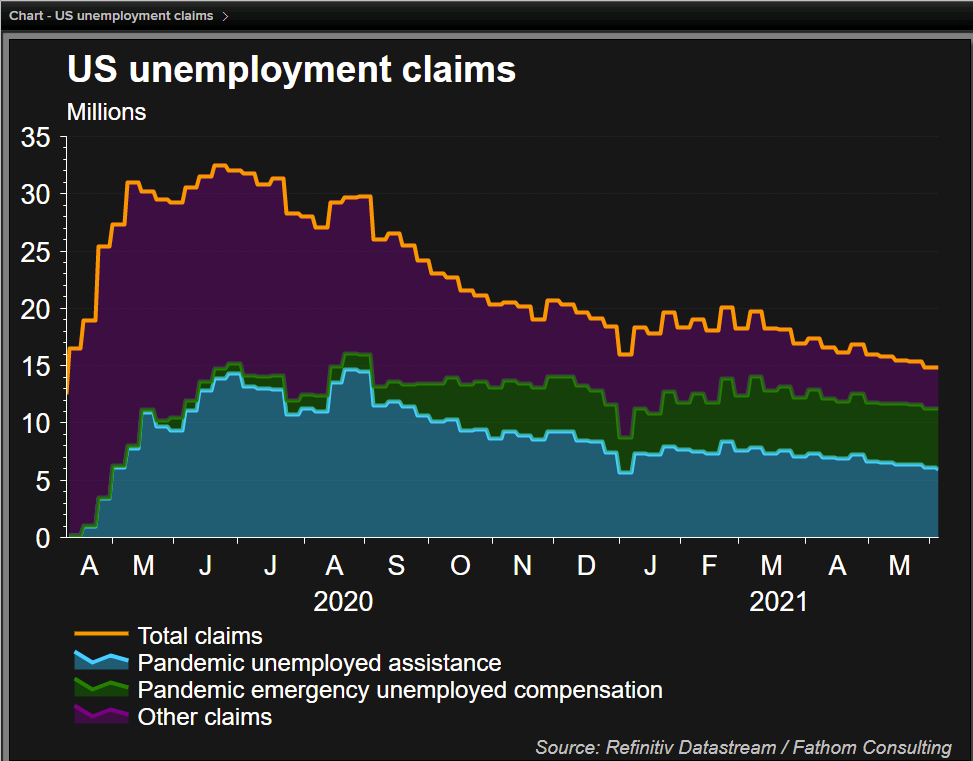

Get unrivalled access to data that moves markets

Whatever you are trading, Datastream gives you extensive access to data you rely on, plus a wealth of unique content: equities and derivatives, futures, convertibles, CDS, macroeconomics, fixed income, funds & ETFs, interest rates, Reuters FX Polls. It’s all there.

Uncover trends and forecast economic conditions with 12 million economic time series. Our history extends as far back as the 1900s for G7 countries, the 1970s for other major markets and the 1980s for smaller countries.

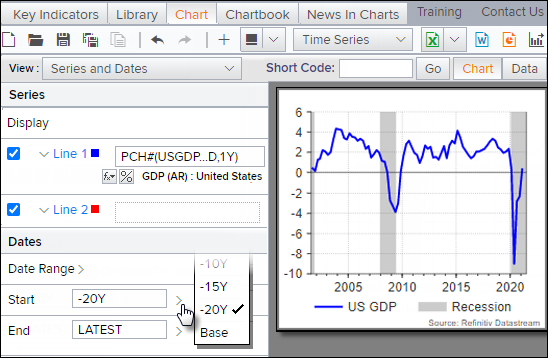

Spend less time formatting charts — and more time making investment decisions

Use market-leading presentation charting tools to succinctly display complex arguments.

Our interactive charting interface has comprehensive tools for slicing, correlation and technical/performance analysis.

Integrated Microsoft Office capabilities allow you to automatically update reports, tables, charts and presentations in Excel, PowerPoint and Word to increase productivity.

Quickly and easily create and customize charts with Datastream charting. Save valuable time using short codes.

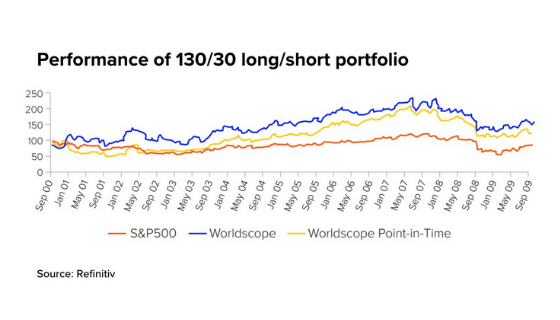

Increase the accuracy and reliability of your backtests with point-in-time data

Datastream offers a variety of point-in-time data sets. As the only data set to include all reported values, timestamped to the moment that they were made available to the market, point-in-time data is unique in showing you exactly what information was available and when, allowing your quants and data scientists to backtest against real conditions.

The result: more accurate backtests, more realistic results and greater confidence that your strategies will perform as expected.

Not using point-in-time data overstates the performance of your backtests; results cannot be replicated in real markets.

Ready to elevate your view of macro? Contact our team for a demo of Refinitiv Datastream.

Refinitiv, is one of the world’s largest providers of financial markets data and infrastructure. Serving more than 40,000 institutions in approximately 190 countries, we provide information, insights, and technology that drive innovation and performance in global markets. Our 160-year Reuters heritage of integrity enables customers to make critical decisions with confidence, while our unique open platform, best-in-class data, and cutting-edge technology bring greater opportunity to our customers. By advancing our customers, we drive progress for the entire financial community.