Refinitiv Point-in-Time Data

Run better backtests, get better strategies.

The most accurate forecasts need the most accurate data. However, using standard data sets, which contain biases, to train machine learning models and run backtests could jeopardize your entire investment process.

GET STARTED WITH REFINITIV POINT-IN-TIME DATA TODAY

Generate the alpha you expect with point-in-time data

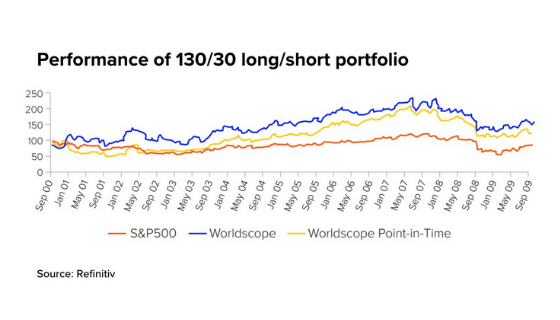

Point-in-time data is the only type of data that can overcome the challenges of standard data sets because it includes all reported, timestamped data. You can backtest against real conditions, with access to reported results and all restatements.

Standard data sets are prone to biases — the key ones being survivorship bias and look-ahead bias — which can lead to backtests of investment strategies overstating achievable results and machine learning models being incorrectly trained.

With Refinitiv point-in-time data you will:

> Train ML models that are more effective

> Run more accurate backtests

> Get an accurate picture of history

> Gain confidence that your strategy will perform as expected

> Build your edge over competitors who are still using standard data sets, with their inherent biases

Access the industry's most comprehensive offering of truly point-in-time content

Refinitiv offers the most types of point-in-time content, the broadest coverage, and the most amount of data items per content set in the industry.

Refinitiv ESG Point-in-Time Data *NEW*

Over 11,000 companies covered, accounting for 80% of global market cap, with relevant and consistent data across 500+ measures.

Refinitiv Worldscope Fundamentals Point-in-Time

Coverage of almost 90,000 companies, dating back to 1983, timestamped to the day and updated daily.

Refinitiv Financials Point-in-Time

Coverage of over 100,000 companies, dating back to 1980, timestamped to the day and updated daily.

Refinitiv I/B/E/S Point-In-Time

The only point-in-time Estimates data available in the industry. Coverage of over 80,000 companies, dating back to 1980, updated weekly with daily timestamping.

Refinitiv MarketPsych Analytics

Real time sentiment scores derived from news and social media for companies, commodities, and currencies. Coverage of 15,000+ companies, 36 commodities and energy subjects, 187 countries, 62 sovereign markets, 45 currencies and 150+ cryptocurrencies, back to 1998 (2009 for cryptocurrencies), timestamped to the second.

Refinitiv MarketPsych ESG Analytics

Real time ESG data evolved out of news and social media to capture key ESG themes in twelve languages for 30,000+ global companies and 252 countries and regions.

Refinitiv Economics Point-In-Time

Over 10,000 key indicator economic series, with up to 20 years of history.

Refinitiv Pricing and Market Data

20 years of tick-by-tick history including full order book. Global coverage of OTC & exchange-traded instruments, from 500+ trading venues and 3rd party contributors.

Refinitiv Real-Time News

Coverage of over 90,000 companies, dating back to 1996, timestamped to the millisecond and updated in real-time.

News Analytics

Sentiment analytics for every Reuters article. Coverage of 90,000+ companies, back to 1996, timestamped to the millisecond and updated in real time.

Know what the market knew, when it knew it, with Refinitiv point-in-time data

Get the best returns with Refinitiv point-in-time data

Since 2010, we have processed more than one million restatements and reclassifications across global markets, underscoring just how often standard data sets are updated. Figures from the past change frequently, meaning that you could be using data in your backtests that was not actually known to the market at the time.

By providing data that is timestamped to the moment it was made available to the market, point-in-time data is unique in showing you exactly what information was available and when.

With point-in-time data, you can eliminate biases and lag assumptions, and have greater assurance that your strategies will perform as expected. Get an edge over competitors who are still using standard historical data, with its inherent biases, and start to train ML models that are more effective. Get started with Refinitiv point-in-time data today >

WEBINAR: How to use point-in-time data to avoid biases in backtesting

We joined forces with Mathworks to look at point-in-time data eliminates common biases in standard historical data sets: survivorship bias and lookahead bias. Listen to the webinar >

BLOG: Why is point-in-time data essential?

Analysis of Refinitiv data reveals that over one million restatements and reclassifications have been made to original filings since 2010. We explore how this reinforces the need for quants and data scientists to implement point-in-time data. Read the blog >

Refinitiv, is one of the world’s largest providers of financial markets data and infrastructure. Serving more than 40,000 institutions in approximately 190 countries, we provide information, insights, and technology that drive innovation and performance in global markets. Our 160-year Reuters heritage of integrity enables customers to make critical decisions with confidence, while our unique open platform, best-in-class data, and cutting-edge technology bring greater opportunity to our customers. By advancing our customers, we drive progress for the entire financial community.